Amazon Connect Voice ID no longer available

Amazon has announced that after careful consideration, they would end support for Amazon Connect Voice ID, effective 20 May 2026. They will no longer accept new customers beginning May 20, 2025 and existing customers will be unable to use Amazon Connect Voice ID features after 20 May 2026.

Amazon recently started a preview of their own Voice BiometricsVoice Biometrics uses the unique properties of a speakers voice to confirm their identity (authentication) or identify them from a group of known speakers (identification). authenticationAuthentication is the call centre security process step in which a user's identity is confirmed. We check they are who they claim to be. It requires the use of one or more authentication factors. technology, Voice ID, for their Amazon Connect contact center platform. The initial product is on paper, more than good enough for a wide range of use cases so is sure to be disruptive for end-user organisations, contact centre platform and voice biometric technology. This is a move we long predicted but didn’t think would come so soon or be as disruptive.

Overview

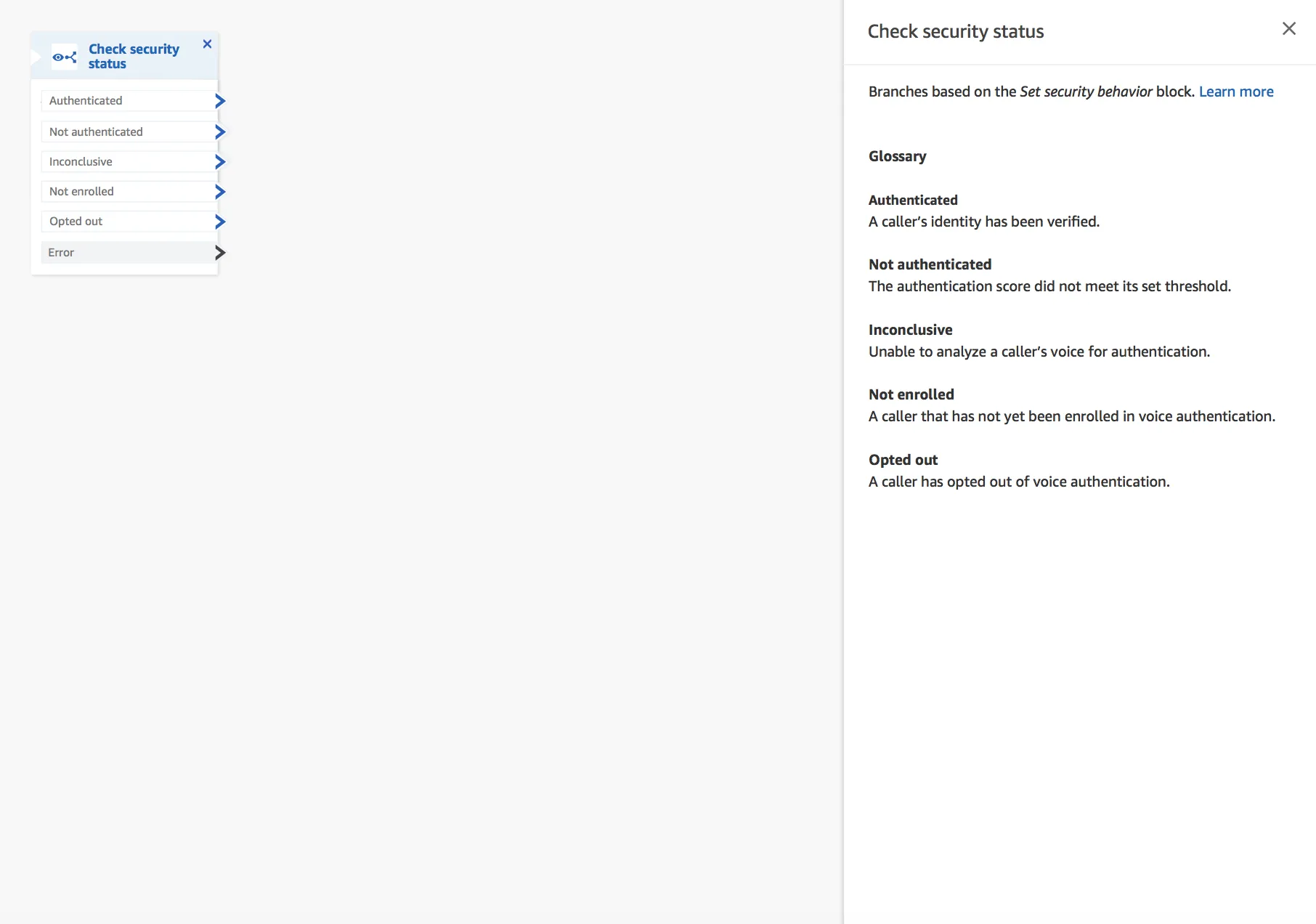

Voice ID is based on text-independent Voice Biometrics so doesn’t require the caller to say anything specific but does require an extended conversation to enrol and authenticate. The integration pattern is consistent with most products in the market, but the execution is a lot slicker due to Amazon’s control of the underlying platform. Using Amazon’s graphical editor, only a few blocks need dropping in a contact flow (used in Amazon Connect to handle both IVR and Agent interactions). Amazon’s Contact Centre Control Panel (the default agent control panel) has been updated to enable enrolmentEnrolment is a step in the registration process where specific utterances are requested from the user or previously acquired audio is used to create a Voice Biometric template (Voiceprint) for subsequent use in Authentication/Identification. and authentication through a set of simple API calls. It’s not clear from the write-up whether audio sessions are preserved when they move between IVR and Agent, but the results of an IVR session can be retrieved, and additional authentication started if required but. Amazon has provided a good, write-up of how to use it here.

How does it compare — Key Features

We haven’t got our hands on the service yet so are dependent on Amazon’s documentation for this information. As soon as we get access, we will post a full review and update this article.

- EnrolmentEnrolment is a step in the registration process where specific utterances are requested from the user or previously acquired audio is used to create a Voice Biometric template (Voiceprint) for subsequent use in Authentication/Identification. — Requires 30 seconds of customer audio (excluding silence) consistent with most providers' default position. There doesn’t appear to be any way to change this.

- AuthenticationAuthentication is the call centre security process step in which a user's identity is confirmed. We check they are who they claim to be. It requires the use of one or more authentication factors. — Requires 10 seconds of customer audio (excluding silence) consistent with the default position of most other providers. There doesn’t appear to be any way to change this which may not make it suitable for typical IVR scenarios where typical utterance lengths are 2-5 seconds.

- Biometric Performance — Unknown. Verification scores are returned in the range 1-100 with 100 being the highest confidence and the default being 90, but it’s up to end-users to determine the appropriate threshold for their use case. Amazon hasn’t so far provided any tooling, advice or best practice to help end-users make this decision which in our experience is likely to be a significant challenge when putting any service based on this technology live.

- Pricing — Flat fee of $0.025 per transaction. Transactions include any enrolments, authentications or secondary authentications on the same call. There are several pricing models in the market, but this is our preferred approach as it correlates most strongly to end-user value. This is tremendously good value to the 10-20x that organisations could save in reduced authentication handle time. It will also be challenging for competitors existing delivery models to match for anyone but the largest scale organisations.

- Availability — Currently only available in preview (which has to be requested) from the US-West region which is unlikely to be suitable for UK or EU production purposes. It’s almost certain to roll out to the other Amazon Connect locations (Frankfurt, London, Singapore, Sydney and Tokyo) in the future but there is no published general availability date yet.

- Vulnerability Mitigation — None. Whilst a lower risk with text-independent voice biometricsText Independent Voice Biometrics is a form of Voice Biometrics that is not dependent on the utterance being used during enrolment being repeated during authentication or identification. there is no mention of any synthetic voice or presentation attackPresentation attacks are a form of attack on a biometric system when the fraudster attempts to gain access by presenting a fake biometrics characteristic or artefact. In the case of Voice Biometrics, this is most often with a recording or a synthetic voice. detection technology. This will not be a concern for many organisations who are exceptionally unlikely to see this kind of sophisticated attack. Still, it's worth highlighting that all organisations should consider the reputational and not just fraud risks of implementing this technology.

- Privacy — Amazon has updated their terms and conditions to include specific VoiceID terms. In outline, these require end-user organisations to comply with the law in their particular jurisdictions or use cases pertaining to consentConsent is a step in the registration process where a user provides permission to process their biometric data before enrolment in a Voice Biometric system in a way which complies with applicable data protection and privacy legislation. and indemnify Amazon from any liabilities for failing to comply. Whilst Amazon is clear that VoiceID data and audio are the customer’s data, it is not clear to what extent they are accessible by Amazon to improve the service. This ambiguity needs resolving before production deployment.

- Liability — Amazon’s VoiceID terms expressly transfer all liability for VoiceID decisions to the end-user organisation and clarify that outcomes are probabilistic and should be subjective to accuracy review. This is to be expected and consistent with the fine print of other providers contracts.

Analysis

End Users

We have no reason to believe that given the huge amounts of audio, compute power and talent Amazon has access to, the underlying biometric performance will be out of line with its peers. Based on this assumption, we are confident that Amazon’s offering will be more than good enough for many small and medium-sized organisations considering Voice BiometricsVoice Biometrics uses the unique properties of a speakers voice to confirm their identity (authentication) or identify them from a group of known speakers (identification). as an authentication method. The ease of implementation alone will be enough to encourage many organisations to give it a go. We are excited to see what value can be unlocked in industry sectors that have not traditionally embraced this technology.

Whilst Voice Biometrics has been on many contact centre managers' wish list for years, the barriers to getting started have been significant, and the available technology's reputation has not always been great. This move will reframe the internal debate for many organisations, and we expect many to now be thinking about when to implement not if. It was interesting that Amazon chose a health service provider as their initial case study as we expect that to be a particular growth area.

Whilst the technology may be good enough, and there may now be a greater incentive to act there remains a big gap between technical implementation and business success that will require organisations to apply learning and experience from existing deployments to implement a successful service.

There will also be various organisations, particularly those with high value at risk transactions, regulatory requirements or significant scale, where Amazon’s technology will not be good enough. These can, however, still take advantage of the platform to learn about the technology and their own requirements better through prototyping. We fully expect to use Amazon Connect Voice ID as a rapid prototyping solution during client engagements. This approach and positioning are consistent with speech recognition services from Amazon, Google and others that are good enough for many but still leave a lot of value on the table for more optimised solutions at large scale.

Contact Centre Platform Providers

For other platform providers, Amazon has added another feature that they will be required to implement if only to retain feature parity in enterprise buyers' eyes. Not many providers will be able to compete with Amazon’s internal expertise in this area, so we are likely to see an acceleration of partnerships between existing Voice Biometric technology providers and platforms. To truly compete with Amazon, deep integration with platforms is required, and it remains to be seen which platforms will make this investment of time and effort versus those that deliver marketing gloss. For those who embrace it, the real value is probably increasing platform stickiness rather than recurring revenue. However, to really realise this value, platform providers and their partners will need to expand their services beyond the technology itself to encompass the business processes and behavioural changes required for end-user organisations to implement successfully. It’s unlikely that any platform will want any more than one provider so winners and losers will soon be known.

Technology Providers

As a result of sharing the margin on already low pricing, it’s unlikely that any of these partnerships will be a huge source of short-term revenue for technology vendors. The real value will be the obvious upsell provider when the integrated solution is not good enough.

We see a clear market hierarchy emerging as follows:

- Good — Services tightly integrated with and sold through contact centre platform or as software as a service. Minimal levels of customisation and configuration. Commoditised pricing based on transaction volumes.

- Better — Standardised integrations with most major contact centre platforms, including on-premise options and call recording applications. An extension of the existing app store model. Greater customisation including presentation attack detection and optimisation of biometric algorithms for end-user organisations. Limited counter-fraud capabilities. Higher transactional pricing and additional professional services implementation and support requirements.

- Best — Integrated anywhere you want it as long as you are prepared to pay. Highly customisable. Extensive counter-fraud capabilities. The highest performing biometric algorithms and extensive optimisation support. Higher price, including non-transactional models with ongoing professional service support requirements.

It will be fascinating to watch as market participants figure out where they really want to compete in the future and focus on real differentiation areas. The major market participants were included in the 2020 Intelligent Authentication and Fraud Prevention Intelliview that we publish jointly with Opus Research. We’re really looking forward to starting the fieldwork for the 2021 version in light of this shakeup.

Next Steps

This really is a disruptive move by Amazon, and we can’t wait to see how it plays out over the next few months and years. As soon as we have access to the service, we will post a fuller review so please subscribe to our email list to get notified when it’s available.

If you are interested in implementing Amazon’s Voice ID service and want to understand the practical implications for your business, then you should get in touch or take a look at our implementation checklist.